Insights

-

AI in Your Fundraising Pitch: A Checklist to Impress Investors

Artificial intelligence is no longer just a tech buzzword. It’s sneaking into almost every corner of the business world, from automating customer service to predicting which brand of cereal you’ll crave at 2am. But as AI keeps muscling into the mainstream, a lot of founders are fumbling the one thing that really matters when it…

-

The End of ESG Investing?

President Trump has been outspoken in his opposition to ESG policies. His “drill, baby, drill” stance has led the administration to roll back environmental regulations and cut funding for carbon-reduction initiatives, leaving the energy sector and related industries on unsteady ground.

-

When to Hire a CFO if You’re Thinking of Selling

One of the most common mistakes we see in founder-led businesses preparing for an exit is waiting too long to bring in a seasoned Chief Financial Officer. As soon as a potential sale becomes a serious consideration, even 12 to 18 months ahead of a process, having a strong finance lead in place can make…

-

European Telcos Seek Consolidation

Europe’s telecom giants are reshaping their strategic playbooks. In response to stagnant revenues, rising infrastructure costs, and global competition, the sector is embracing two core strategies: regional consolidation and selective international divestment. The goal is sharper focus, operational scale, and better capital efficiency.

-

Engaging Investors Early: Why Timing Still Matters for Established Businesses

For many founder-led businesses, the decision to raise external capital for the first time comes after years of building the company through organic growth. Whether driven by a desire to accelerate expansion, make acquisitions, or de-risk the founder’s position, the first institutional raise is often a pivotal moment – and how you prepare for it…

-

The Shift to Vertical SaaS Solutions

In 2025, the vertical SaaS market is experiencing significant growth, driven by the increasing demand for industry-specific solutions that address unique operational challenges. Vertical SaaS platforms offer tailored functionalities for sectors such as healthcare, finance, or retail, providing enhanced efficiency and compliance compared to their horizontal counterparts.

-

Due Diligence in AI Investments: Risks for Investors

As AI continues to rapidly evolve, investors must adapt their due diligence to address emerging risks. Many regulations are outdated, and overlooking key red flags can lead to costly legal and operational challenges.

-

Exit Planning in a Soft Market: What Founders Need to Consider Early-On

A softer M&A market doesn’t mean opportunities aren’t out there, it just means preparation matters more. For founders eyeing an exit in the next 12 to 24 months, now is the time to get ahead of the curve.

-

SAP Overtakes Novo Nordisk as Europe’s Most Valuable Company

German software group SAP has surpassed Danish pharmaceutical company Novo Nordisk to become Europe’s most valuable company last week. Last Monday, SAP’s shares rose by 1.35%, elevating its market capitalization to nearly €313.70 billion. Interestingly, this is down nearly 10% from the all-time high it reached in February, but the company has managed to stay…

-

The Possible Effects of US Tariffs on Dealmaking

Private equity deal flow appeared to be making a tentative recovery in 2024. The outlook under the Trump administration was broadly positive due to its perceived support for deregulation, but Trump’s tariff stance could impede recovery.

-

The Take-Private Boom: Large Deals on the Rise in 2024

Take-private transactions surged in 2024, with the total value of European deals involving a majority stake of over $1 billion rising 44% to $52 billion. According to Dealogic, 15 such deals were completed, compared to just 10 the year before, reflecting a renewed appetite among PE firms to acquire undervalued public companies.

-

Down Rounds on the Up

Down rounds have become increasingly common in US and European VC fundraising. According to Forbes, approximately 20% of all US VC rounds in 2024 were down rounds – a notable increase from the historical average of around 10%. In Europe, both 2023 and 2024 also experienced a higher percentage of down rounds, even as the…

-

AI and Digital Infrastructure Drive M&A in the Tech Sector

The Telecom, Media & Technology sector led all M&A activity in EMEA in 2024, with total deal value reaching €194.5 billion, an 11.9% increase year-on-year according to data provided by Datasite. This surge was primarily driven by two key themes: the growing role of AI in strategic acquisitions and the increasing investment in digital infrastructure…

-

M&A Outlook 2025

The global M&A landscape in 2023 and 2024 was subdued; however, 2024 showed pockets of growth, with some countries recording significant increases in deal volume. Canada stood out with a remarkable 59% rise in M&A activity compared to 2023. Conversely, regions such as the Nordics, Benelux, and China experienced lower volumes than the prior year.…

-

PE Investment Outlook for 2025

PE investment has been slow over the last few years, with funds facing challenges in finding exits. The low exit volume has led to longer holding periods, slower fund lifecycles, and limited new capital for investment. Now we turn our sights to Ethiopia, which is set for a bumper IPO year in 2025. As a…

-

Key Trends in SaaS for 2025

The enterprise telecom industry, challenged by shrinking revenues and cloud competition, is now leveraging AI to revive growth. As businesses migrated to cloud platforms like AWS and SAP Hana, telcos lost their traditional role in connectivity, facing margin pressures as enterprises prioritised cost savings; however, AI’s rise offers telcos a strategic resurgence by demanding robust…

-

How AI is Reshaping Enterprise Telecommunications

The enterprise telecom industry, challenged by shrinking revenues and cloud competition, is now leveraging AI to revive growth. As businesses migrated to cloud platforms like AWS and SAP Hana, telcos lost their traditional role in connectivity, facing margin pressures as enterprises prioritised cost savings; however, AI’s rise offers telcos a strategic resurgence by demanding robust…

-

IPO Pipeline

In November, we touched on a few spin-offs happening in global markets, including two in South Africa. Now we turn our sights to Ethiopia, which is set for a bumper IPO year in 2025. As a country with 123 million people, it has been one of the largest countries without a stock exchange.

-

The Financial Services and Markets Act 2023: Unlocking New Fundraising Opportunities for Mid-Market Companies

The Financial Services and Markets Act 2023 (FSMA 2023) introduces reforms aimed at enhancing the UK’s capital-raising ecosystem. For mid-market investment banks, these changes simplify the fundraising process, making it easier and more cost-effective for smaller enterprises to access equity and debt markets.

-

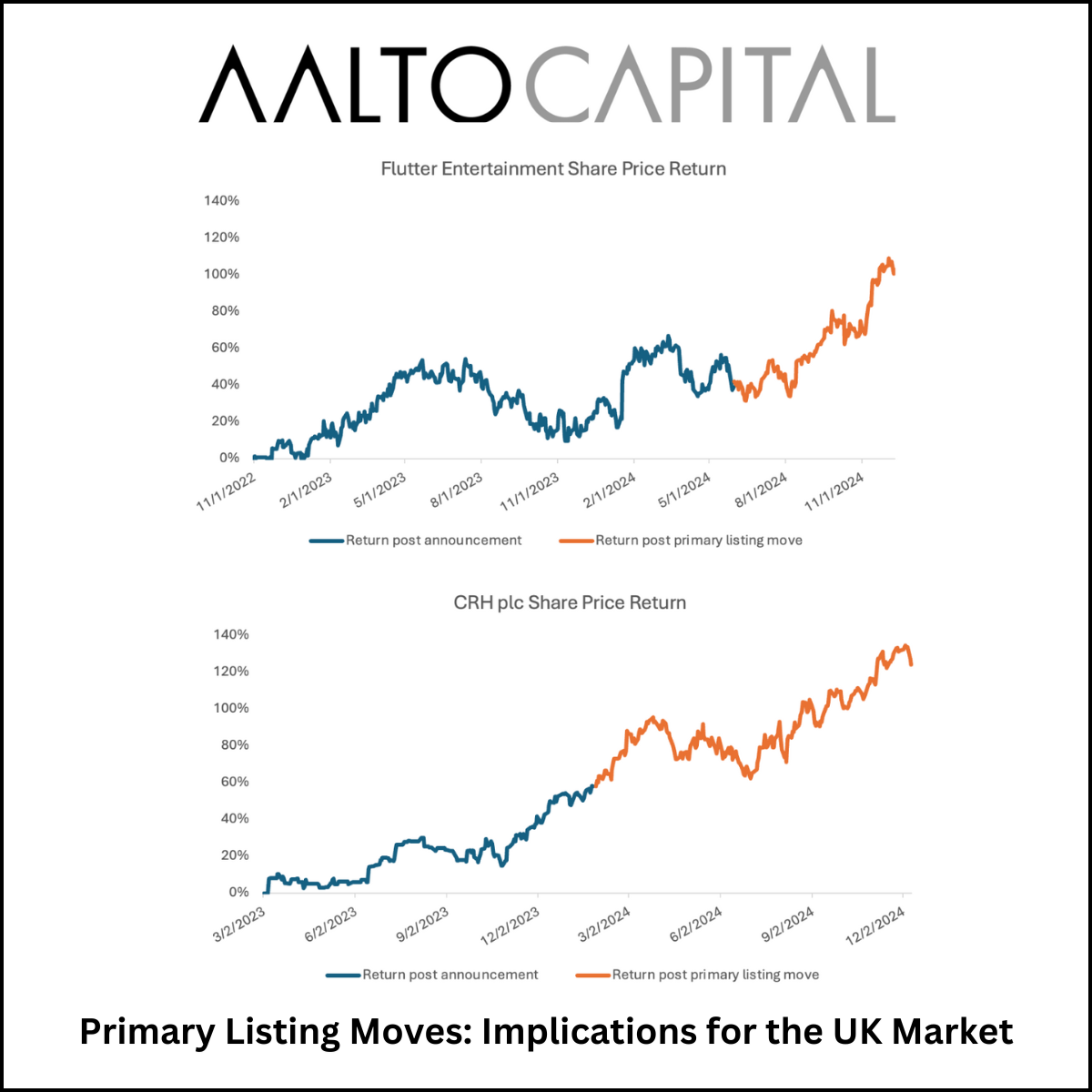

The Growing Trend of Primary Listing Moves: Implications for the UK Market

Previously, Aalto Capital explored the “synergy gap,” noOver the past year, Aalto Capital has explored valuation discrepancies between Europe and the United States, focusing on the AIM market. This segment represents mid-market, higher-growth companies, many of which face unique challenges compared to larger, more mature businesses.ting that our research showed strategic buyers don’t always pay…

-

Strategic vs. Financial Buyers: What CEOs Need to Know Before Selling

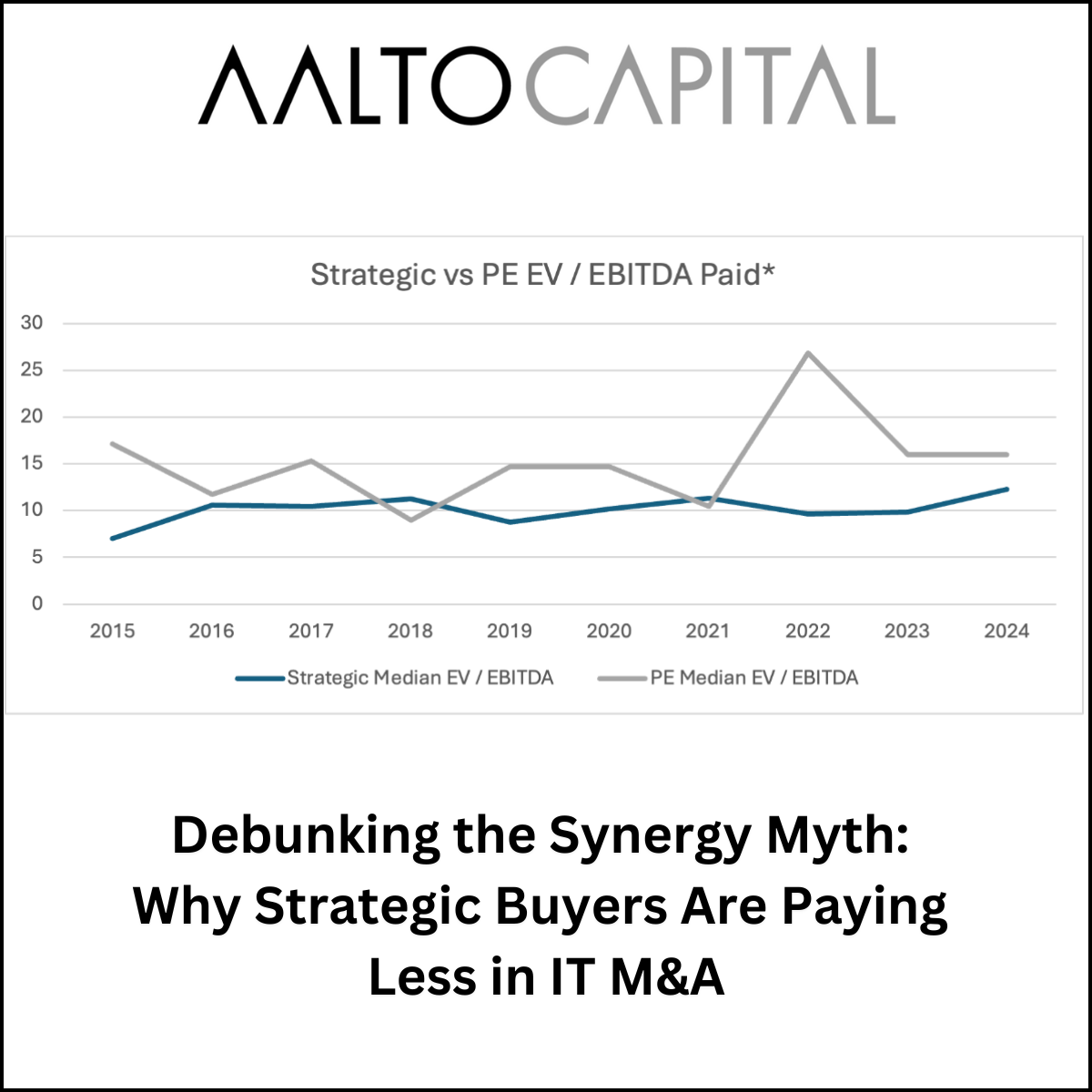

Previously, Aalto Capital explored the “synergy gap,” noting that our research showed strategic buyers don’t always pay higher premiums in IT M&A. While valuation remains a top concern for most founders, it’s equally vital to understand the broader implications of selling to a strategic versus financial buyer.

-

Reflecting on 2024 Global Trends

2024 has been a cautious year for investors, shaped by global economic and political uncertainty. Key elections worldwide, ongoing conflicts in Europe and the Middle East, high inflation, and looming recession fears created a challenging environment across all sectors and asset classes.

-

Listed Company Spin-Offs

Although there have not been many major IPOs this year, listed entities are increasingly opting to distribute unwanted subsidiaries to shareholders via spin-offs rather than selling them to private equity buyers.

-

UK Mid-Market M&A Sees TMT Uptick Amidst Economic Recovery

The UK’s mid-market M&A sector is bouncing back. The latest data shows that deal value is up, reflecting the stabilizing economic environment and presenting new opportunities for mid-market businesses and advisory firms.

-

What Another Trump Administration Could Mean for Global Business

Donald Trump’s most recent win has unsurprisingly made waves across the globe. US markets, which were performing well – albeit tentatively – before the election, experienced strong growth following the results. Scott Bessent’s appointment as Treasury secretary last month further boosted US markets, reflecting American confidence in both Bessent and the broader Trump agenda.

-

Merger Announcement from Aalto Capital London

We are delighted to announce the merger of the transaction team at GrowthWorks, a boutique advisory firm specializing in the technology, media, and telecommunications (TMT) sectors, with Aalto Capital. This merger will see the GrowthWorks transaction team join Aalto’s London office as the cornerstone of our new TMT practice, further solidifying our commitment to providing…

-

AIM’s Continued Struggle

The Alternative Investments Market (AIM) of the London Stock Exchange (LSE) has had a difficult time in recent years. The market was established in 1995 for smaller, high-growth companies to access capital, and at its height in 2007, there were 1,694 AIM-listed companies.

-

SaaS Shift to Usage-Based Pricing Models

The Software as a Service (SaaS) industry is witnessing a significant shift from traditional subscription-based pricing to usage-based models. This transformation is not only reshaping revenue streams but also affecting how investors value SaaS companies.

-

ESG Update – The UK Pushes for Energy Digitisation

In 2022, the Energy Digitalisation Taskforce put forward a recommendation to develop a ‘digital spine’ across the energy sector. This digital spine is a proposed sector-wide data sharing mechanism, intended to enable the seamless and secure transfer of data and information between all participants in the energy market.

-

Accounting Firm Roll Ups

Accountants, auditors, and tax consultants are unlikely to go out of business anytime soon. Indeed, so long as there are financial regulations and corporate taxes for businesses to contend with, this sector will always be needed.

-

The Impact of Reduced Interest Rates on PE and M&A

The last two years have seen decreased deal activity, largely due to incompatible valuation expectations between investors and management teams, as well as economic and geopolitical uncertainty. Across the board, we at Aalto have seen longer processes and greater hesitation…

-

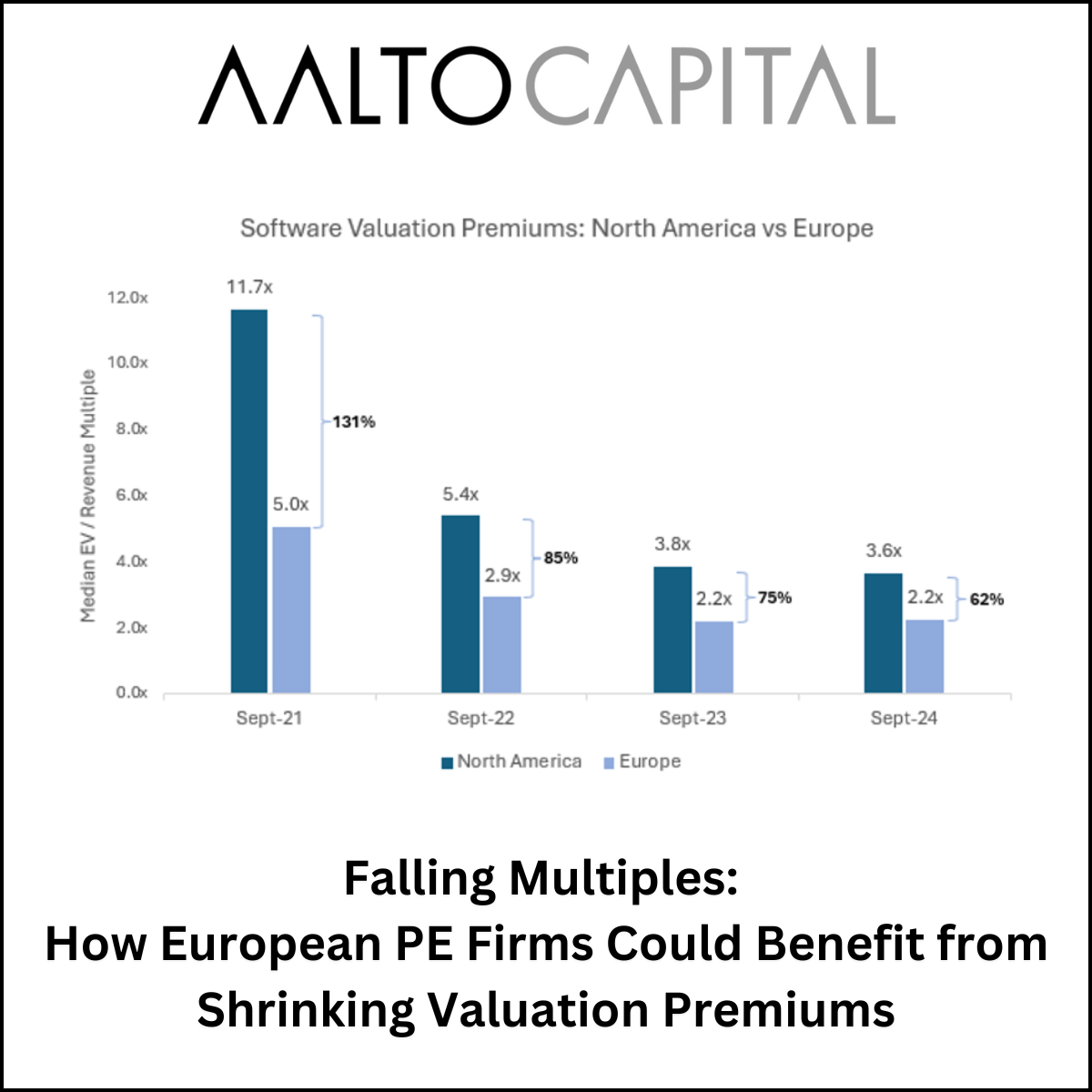

Falling Multiples: How European PE Firms Could Benefit from Shrinking Valuation Premiums

In previous articles, Aalto Capital has explored several key trends shaping the software industry, such as the size premium that favours larger companies and the role of the Rule of 40 in balancing growth and profitability.

-

Soaring Global Debt

In 2016 the global debt was approximately $220 trillion, 320% of global GDP. This ratio has continued to increase over the last 8 years, due to various factors such as increased social spending and COVID support funding.

-

Could Emerging Weight Loss Drugs Signal the End of Processed Food?

Novo Nordisk’s rapid rise as Europe’s largest company has largely been attributed to its ground-breaking drug, Semaglutide, which is the active ingredient in Ozempic, Novo Nordisk’s diabetes medication, and its weight loss medication, Wegovy.

-

Is Now a Good Time to Issue Private Debt?

In early August, investors were spooked by a jump in the US unemployment rate, which had risen to 4.3% in July. This is the highest level in three years and sparked a widespread sell-off. Concerns, however, that this increase signals the start of a more severe economic downturn are likely exaggerated.

-

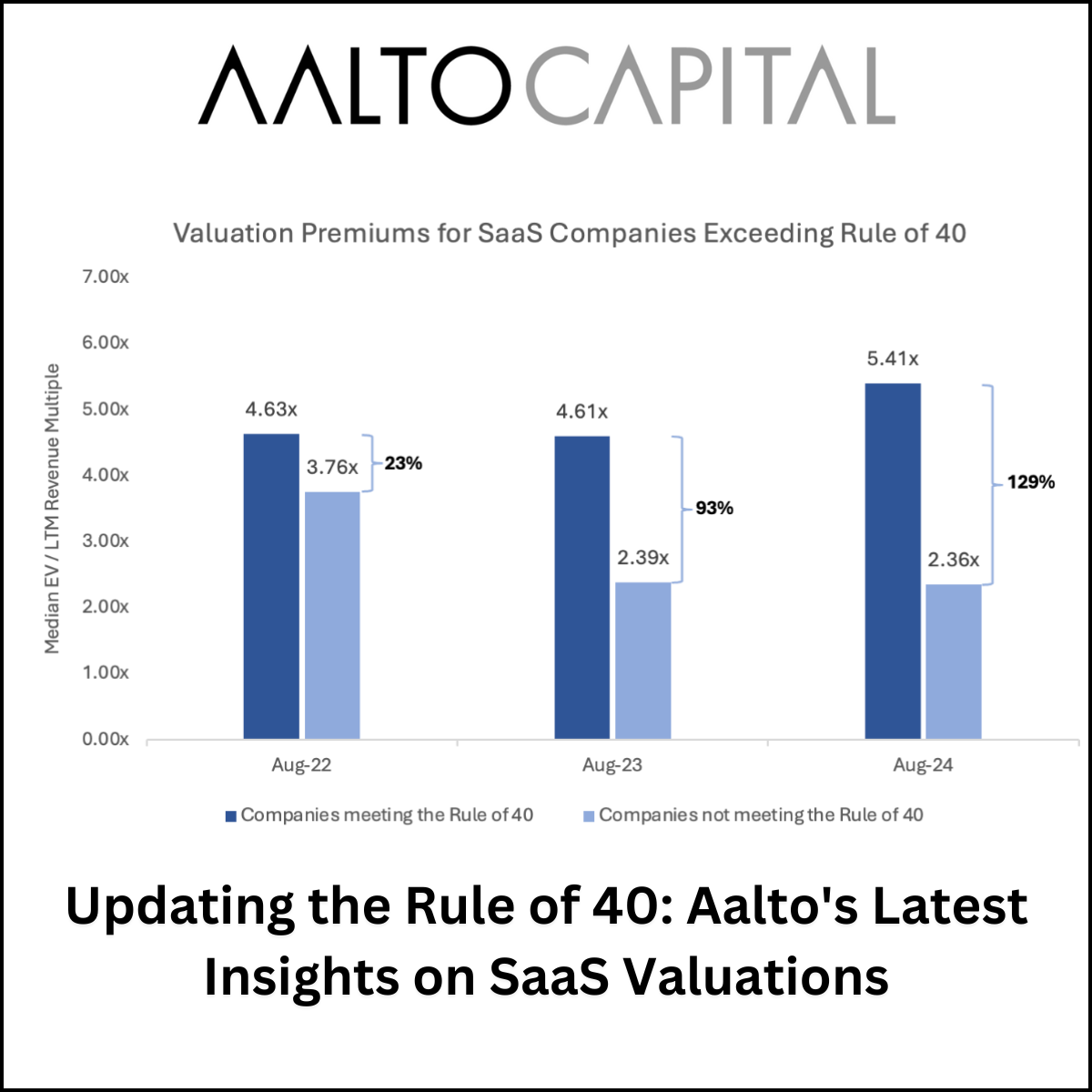

Updating the Rule of 40: Aalto’s Latest Insights on SaaS Valuations

Last year, Aalto published an article on the Rule of 40, a metric that balances growth and profitability to measure SaaS company valuations. The previous analysis, based on research by Allied Advisors, examined 149 SaaS companies and defined the Rule of 40 as the sum of revenue growth and net profit margin.

-

The Impact of Higher Interest Rates on Private Equity

Increased interest rates have undoubtedly made the private equity landscape more complex and challenging. Leveraged buyouts, a common PE strategy, and high interest rates do not go hand in hand. With the increased borrowing costs, LBOs are significantly more expensive, making it harder to achieve the high level of returns that LPs expect.

-

The ESG Update: The Need for More Diversified Climate Tech Investment

Climate tech has become a common term throughout the investment world, and though there is plenty of evidence pointing to its efficacy, there are still concerns about reaching the levels of change required to make headway against global warming.

-

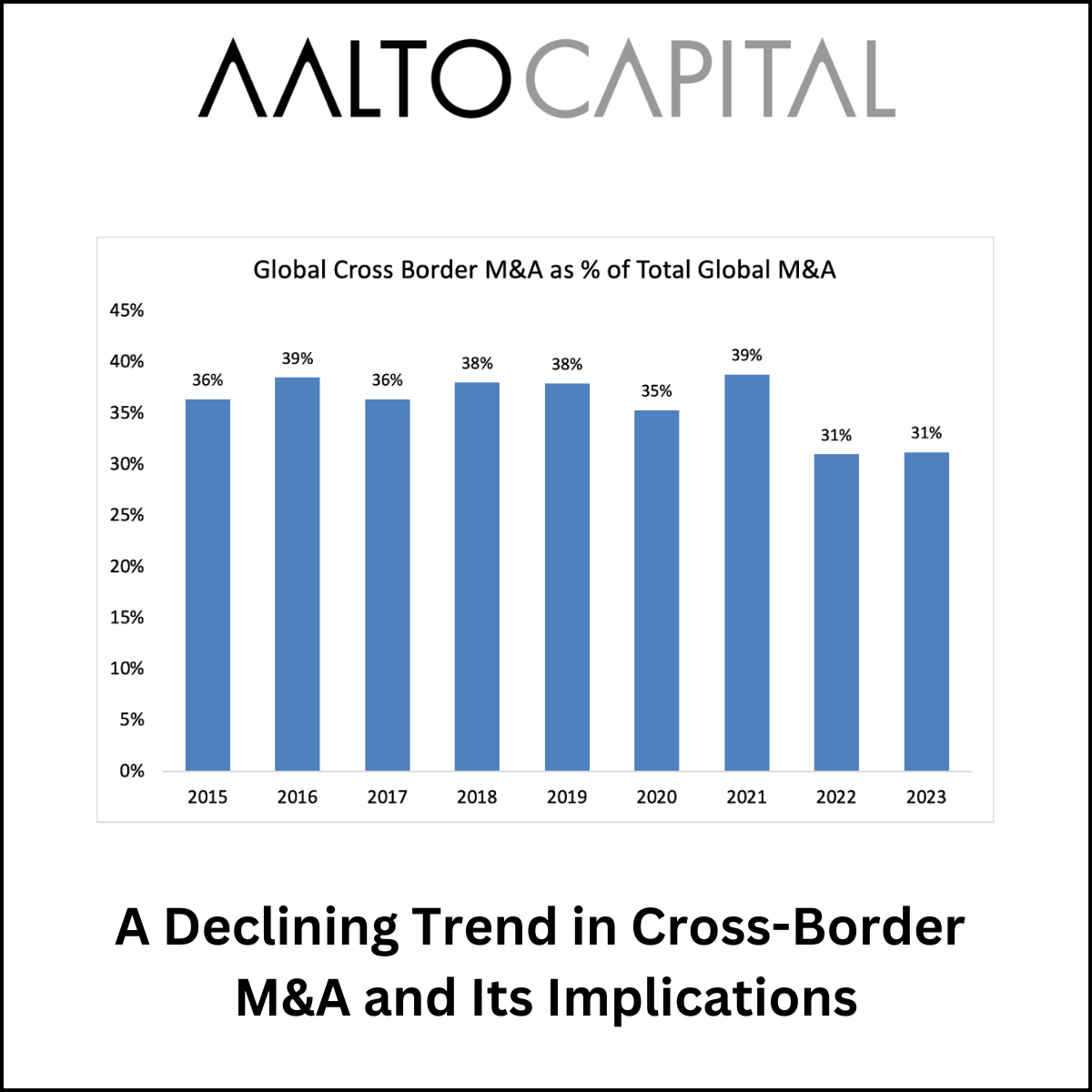

A Declining Trend in Cross-Border M&A and Its Implications

Cross-border mergers and acquisitions offer several benefits, such as market expansion, access to new technologies, and diversification of revenue streams. Given our European corporate finance advisory network, cross-border M&A remains an important part of our business and we are engaged in a number of cross-border transactions.

-

Where to next for UK and European rates?

Global markets have experienced the most rapid and aggressive rate hiking cycle of this century. Remarkably, global economic conditions have remained resilient. Labour markets have been robust, consumer spending has held strong, and we are yet to see anything meaningful in the way of defaults.

-

Integrating ESG into Supply Chains: Navigating New Regulations and Enhancing Sustainability

Sustainability has rapidly transitioned from a voluntary initiative to a mandatory requirement driven by new regulations and evolving stakeholder expectations. Many companies are grappling with regulatory complexities and the need to adapt swiftly.

-

Small- and Mid-Cap Take-Private Interest

In the last year North American and European small- and mid-cap public companies attracted more interest from private equity investors than large-cap public companies.

-

EU Cracking Down on “Greenwashing” in Fund Names

Aalto Capital had the pleasure of attending the ESG Fintech Forum earlier this month, where some of the biggest ESG roadblocks were addressed, along with the role technology will play in transforming strategy. One of the many intriguing topics discussed was “Greenwashing,” the deceptive practice of marketing financial products as environmentally friendly or sustainable when…

-

Financial and Strategic Investors Find Common Ground

The private equity and venture capital sector as a whole has seen a shift in recent years to a more hands-on approach. Increased competition between investors for quality companies and a less predictable and rapidly changing macroeconomic environment have prompted investors to be more involved in the businesses they invest in. Moreover, ESG campaigns and…

-

The Rise of Megafunds: How Large Players Are Dominating Private Market Fundraising

Recent data reveals a notable trend in private market fundraising: the increasing concentration of capital among a few large players. According to the Q1 2024 Global Private Market Fundraising Report by PitchBook, the total capital raised in the first quarter was comparable to the previous year; however, the number of funds has dropped significantly, with…

-

Private Equity Fundraising is Making Modest Strides

Just as many growing companies seek investment from private equity funds, those funds must find investors themselves in the form of limited partners (LPs). Fundraising volume is therefore a strong proxy for the level of overall private market investment activity.

-

Debunking the Synergy Myth: Why Strategic Buyers Are Paying Less in IT M&A

In M&A, it’s often believed that strategic buyers pay more than PE firms due to expected synergies. Our recent research on the IT sector, however, reveals that from 2015 to 2024, PE buyers paid higher multiples than strategic buyers in most years.

-

Strategic Investors Take the Lead

Aalto Capital had the pleasure of attending the 2024 Mergermarket Forum in London last month, where many fascinating topics and views were discussed and debated. At this year’s event, it was mentioned that strategic investors accounted for 76% of deal flow in the first four months of 2024 – a strikingly high proportion.

-

Low trading turnover: implications for shareholders and investors

Building on Aalto Capital’s previous exploration of the IT Services sector in Europe, which revealed a significant discount at which smaller-cap stocks trade compared to their larger counterparts, we delve into another critical metric: trading turnover.

-

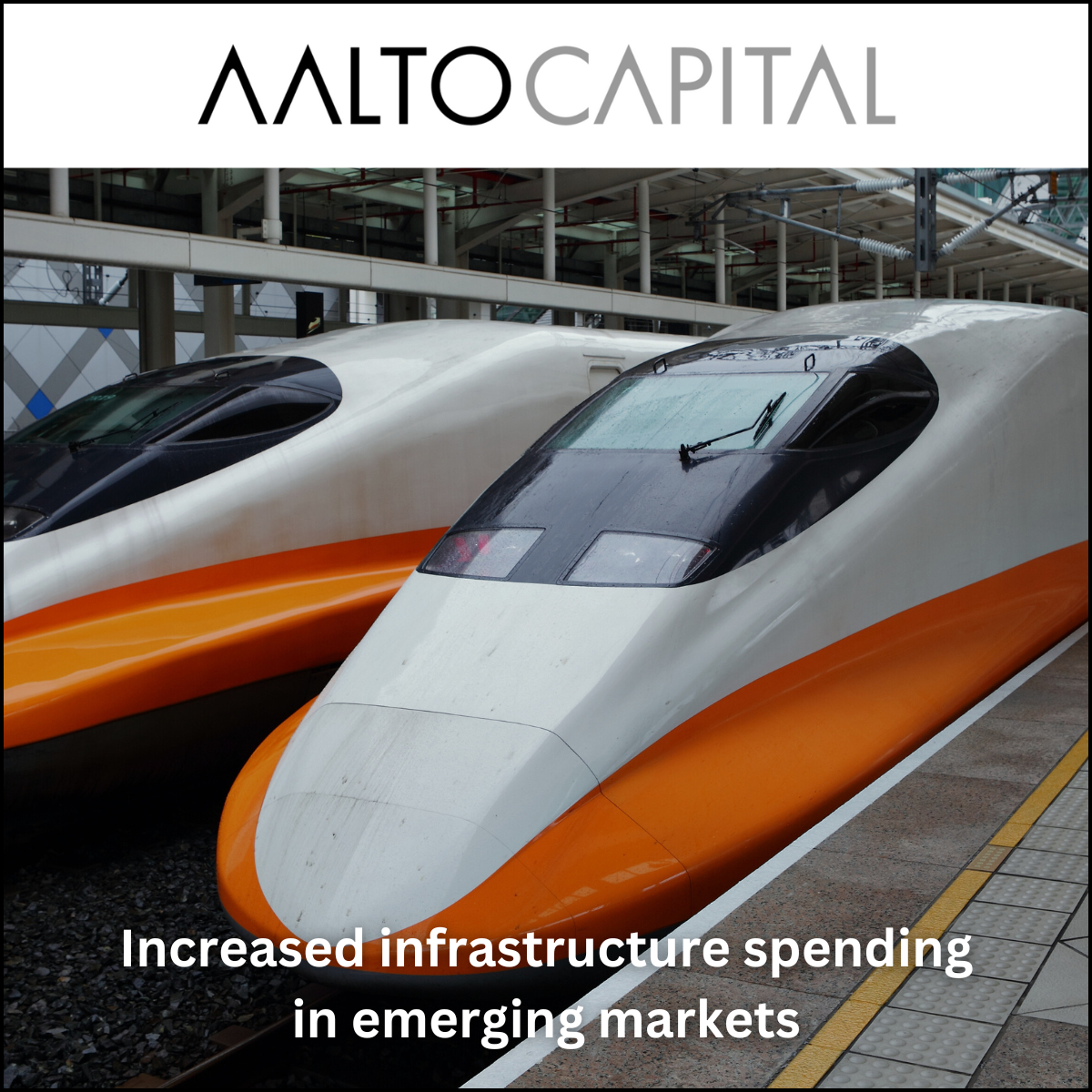

Increased infrastructure spending in emerging markets

China opened 4,100 kilometres of new railways in 2022 alone. For context, most of the UK’s rail system is managed by Network Rail, which has 15,811 kilometres of rail under management. The UK is home to the oldest rail network in the world, with the London Underground allowing the city to be a continued hive…

-

Remembering the S and G in ESG strategic planning

With recent focus on geopolitical tensions and macroeconomic uncertainty, ESG news has cooled in recent months. Still, progress is being made, and companies and investors continue to view sustainability initiatives positively. According to KPMG, US CEOs expect to see significant returns from investing in sustainability within the next five years. Moreover, investors continue to prioritise…

-

Navigating the road to sustainable transportation

Last month, we wrote about the urgent need to decarbonise the built environment, which contributes nearly 40% of global carbon emissions. Now, we turn our attention to another major emitter: the transportation industry, responsible for roughly one-fifth of global emissions.

-

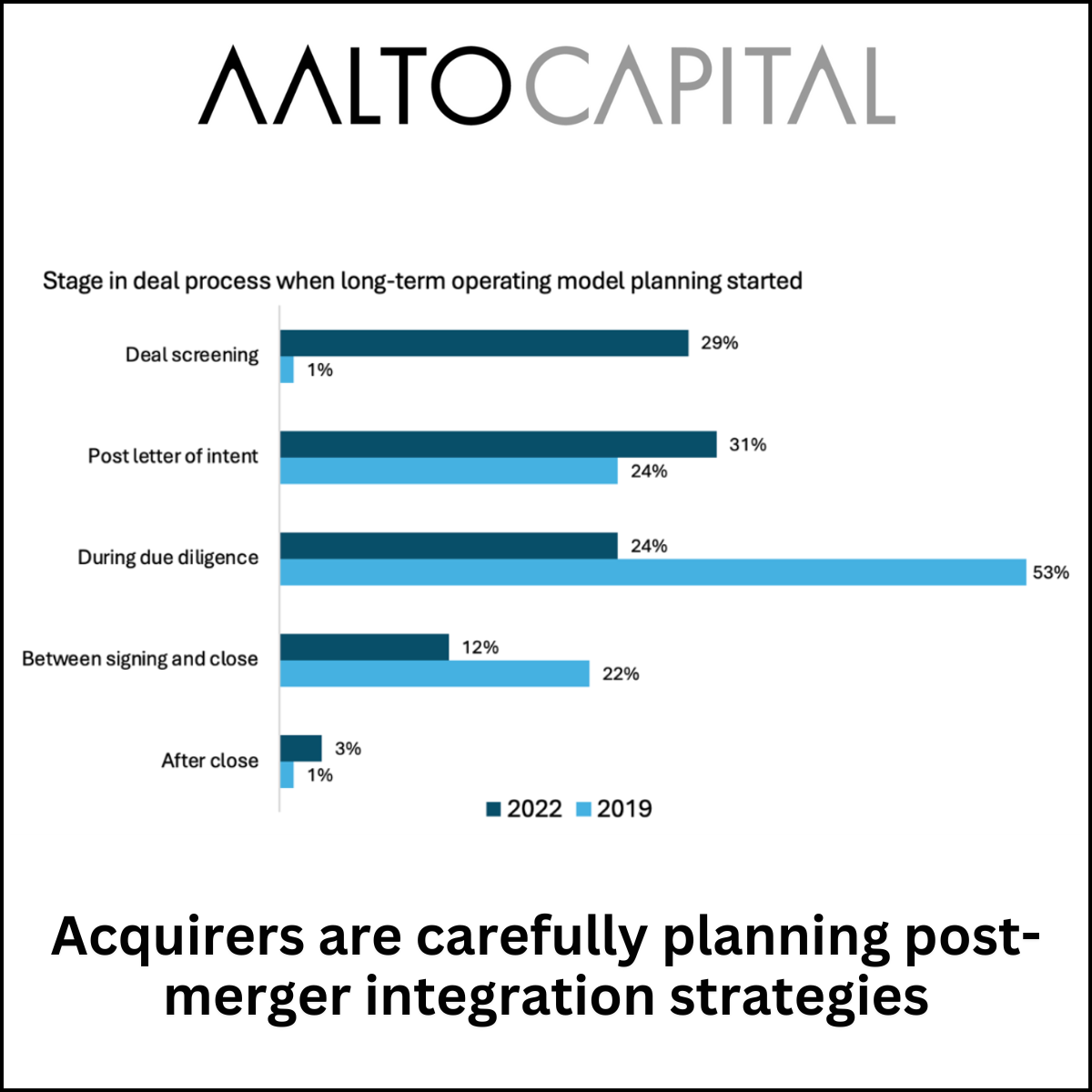

Acquirers are carefully planning post-merger integration strategies

To optimise value during post-merger integration and safeguard against valuation drops, management teams must enact comprehensive strategies to ensure successful company integration and enhance subsequent increases in valuation.

-

NAV financing in the spotlight

After the 2021 private equity boom and the underperformance of many (mostly technology) companies, many PE funds are now struggling to realise returns and raise follow-on capital from their LPs. Some private equity firms are turning to NAV financing to supplement their traditional LPs’ funding.

-

Small-cap strategies for growth in the M&A market

Small-cap strategies for growth in the M&A market In 2023, the M&A market faced notable challenges, with global deal value dropping by 15%, reflecting the impact of high interest rates and geopolitical tensions. Another important consideration is growing antitrust scrutiny. According to Allen & Overy, prohibited transactions rose by 50% in 2023 across 26 jurisdictions…

-

Decarbonising the built environment

The built environment is by far the largest contributor of carbon emissions, accounting for 37% of global emissions, according to the UN Environment Programme. Operational emissions, like heating, cooling, and lighting, comprise the majority of building emissions, while materials and construction are also held responsible.

-

The role of customer success in driving sustainable growth

The role of customer success in driving sustainable growth We have previously emphasised the significance of retention metrics in the SaaS industry. As investors increasingly prioritise sustainable business models, companies are under pressure to enhance their customer retention strategies. One avenue that SaaS companies can focus on to address this is ‘Customer Success’…

-

The need for deeper due diligence in a world of new technology-related risks

The need for deeper due diligence in a world of new technology-related risks AI companies are growing at a rapid pace and must comply with likely out-of-date regulations. As such, companies, investors, and advisors must be weary of new hurdles when performing due diligence, given that red flags uncovered in processes can derail transactions and…

-

Government regulations impact M&A strategies

With an acceleration of technological advancements and critical issues such as climate change, government regulations have emerged which will directly impact businesses and M&A activity. While some may slow dealmaking, other regulatory changes present M&A opportunities.

-

Is it hydrogen’s time to shine?

Hydrogen may finally be taking centre stage in the energy transition after years of hesitant investor sentiment. Though other areas of the cleantech market have somewhat stalled among uncertain macroeconomic conditions, hydrogen has continued to see interest from investors.

-

First mover – advantage or not?

Unlocking value in the era of public-to-private transactions In 2023, global private equity public-to-private deals reached a 16-year high, and according to Preqin, 2024 is likely to witness a continuation of this trend.

-

Exploring hybrid capital opportunities for mid-market companies

Over the past decade, there has been a significant diversification of financing options for businesses as the venture capital and private equity ecosystems evolved. Other options including venture debt have also developed for companies too premature for traditional bank debt.

-

Unlocking value in the era of public-to-private transactions

Unlocking value in the era of public-to-private transactions In 2023, global private equity public-to-private deals reached a 16-year high, and according to Preqin, 2024 is likely to witness a continuation of this trend.

-

A 2024 Turnaround?

The uncertain and unfavourable market conditions of 2023 created an environment that hindered the growth of M&A volume and value. Across various industries, factors such as uncertainty surrounding macroeconomic conditions…

-

International Expansion Demands Cultural Understanding

Expanding a business across borders, whether through organic or inorganic growth, is an enticing prospect for management teams and investors seeking increased market reach. However, the pivotal factor often overlooked in the pursuit of global expansion is cultural integration.

-

How to Identify P2P Candidates

In September, Aalto commented on the increase in public-to-private (P2P) transactions seen in the first half of 2023. This trend has continued into the second half of 2023, and Mergermarket reports that the total number of UK P2P transactions this year is up 145.5%…

-

The Rising Importance of Efficiency Metrics in the SaaS Industry

Last year, we discussed the increasing significance of retention metrics in the Software-as-a-Service (SaaS) sector. Another crucial element that SaaS companies should focus on are efficiency metrics.

-

It Services: 2023 Industry Snapshot

In December, Aalto Capital released its latest Insight Paper, “IT Services: 2023 Industry Snapshot,” exploring key aspects of the IT Services sector. The report describes the current market environment, emerging trends, growth impediments, and M&A dynamics.

-

The Importance of Identifying and Retaining Talent

Earlier this year, Aalto published an article identifying key factors which should be considered when assessing a potential M&A transaction. One factor we highlighted for achieving a successful transaction was the retention of key talent and identification of new talent as necessary.

-

Are There Benefits to Down Rounds?

“Down rounds,” “up rounds,” and “flat rounds” refer to the valuation changes of companies between funding rounds. Up rounds indicate growth and investor confidence, and down rounds signal the opposite.

-

Investor Sentiment Towards Small Cap Stocks

In the current economic climate, morale among small-cap stocks is low. A recent survey by the Quoted Companies Alliance (QCA) found that almost one in four small- and mid-cap quoted companies currently see no advantage in maintaining their listing on the London Stock Exchange.

-

The Impact of Technological Advancements on Competitive Industries

In an era defined by rapid technological progress, the business world has undergone a profound transformation, leading to significant shifts in competitive dynamics.

-

How to Portray Your Target Market to Investors

The acronyms ‘TAM’, ‘SAM’, and ‘SOM’ are often thrown around in investment conversations, but what do these terms mean, and what is the best way for businesses to present them?

-

The Growing Opportunity Cost of Poor Cybersecurity

Last week, the UK hosted the global ‘AI Safety Summit’ which addressed the growing concern over AI-powered cybersecurity attacks, among many other topics. This comes as experts in the field predict AI’s impact on humanity is becoming less and less positive.

-

UK EV Charging Infrastructure Surges Forward Despite Challenges

Despite Rishi Sunak’s recent announcement to scale back the UK’s drive to net-zero, there is some good news for the electrification industry. According to Zapmap, EV chargepoint installations in the UK were up 82% YoY in the first half of 2023.

-

Preparing Your Bootstrapped Company for M&A Success

Bootstrapped companies face unique challenges when it comes to mergers and acquisitions (M&A). These companies may not have the same financial oversight, legal and compliance matters, and intellectual property (IP) management as their larger counterparts, which can make the M&A process complicated.

-

The AI Regulation Trade-off: Market Growth Vs Red Tape

The global shift to widespread use of generative AI highlights its immense value. This limelight has not come without critics, with leading figures in AI discussing the risks associated and how AI may pose a threat to humanity.

-

The Emergence of Universities on the Venture Capital Scene

Academia’s ‘ivory towers’ suggest a detachment from the practical concerns of business and societal issues. However, boundaries between the academic and corporate worlds are becoming increasingly blurred.

-

The Growing Popularity of Public-to-Private Transactions

In the face of a global slowdown, European public-to-private (P2P) transactions increased 43% YoY in the first half of 2023, as tracked by Mergermarket at the end of June. P2P transactions almost matched IPOs in 1H23, totalling 53 and 57 transactions respectively.

-

Private Investment Reshaping Top European Football Clubs

Recent analysis done by PitchBook shows that 36% of top-flight clubs in England, France, Germany, Italy and Spain have private capital ownership in some form. These investors include private equity and venture capital funds as well as consortiums of high-net-worth investors.

-

The Mutual Benefit of IT Services Rollups

Given the number of current players as well as new entrants in the IT services market, private equity investors are encouraging ‘buy and build’ strategies to inorganically grow their investments. According to EY, over half of all private equity deals within the IT services industry were buy and build acquisitions in 2022.

-

Corporate Venture Capital Opens New Avenues for Growth

In recent years, corporate venture capital (CVC) has emerged as a dynamic force in the investment landscape. Last year, CVCs participated in 21.7% of all European VC rounds, the highest annual percentage to date, according to PitchBook.

-

Is Climate Adaptation the Next Big Thing?

Following an increase in unusual weather patterns across the Northern Hemisphere this summer – including record heat waves across Europe – many have started to wonder what a future shaped by climate change might look like.

-

Digital Payments Are Transforming Economies

Physical cheques never gained popularity in Africa, though they remain in use in America; why is this? Slow transportation links, fraud, and limited access to formal banking were to blame on the continent.

-

How to Convince Investors You Are Ahead of the Curve

Being ‘ahead of the curve’ often suggests that a company possesses innovative qualities, setting it apart from its competitors. Yet, proclaiming this without solid evidence could raise eyebrows among potential investors.

-

Selling Shovels in a Gold Rush

As rumours of the discovery of gold spread across the nation, the first millionaire of the California Gold Rush was not mining the gold itself but capitalising on the miners’ needs, selling picks, shovels, and pans. Companies can turn to this metaphor to evaluate whether their business model will stand the test of time, rather…

-

Cava Group’s IPO Triumph Sparks Optimism for PE Exit Opportunities

The PE market is facing an impending maturity wall, but there is a glimmer of hope thanks to Cava Group’s (the VC-backed Mediterranean restaurant chain) listing on the NYSE in June 2023. As the most successful IPO for a US company since July 2022, Cava’s listing signals a potential resurgence in the IPO market.

-

Synergy Identification and Capture in M&A

Identifying synergies between companies is often the first and perhaps the most important step in the acquisition process, as it should in most instances form the foundational justification for a merger or acquisition.

-

The Essential Role of Recognising Competitors While Fundraising

Securing funding for a company is a complex task, and one of the most underestimated elements is the acknowledgement of competitors. It is a common mistake for founders and CEOs to claim that they face little or no competition. Such a scenario is, in fact, rarely the case and often serves as a red flag…

-

Unlocking Liquidity: The Growth of Private Market Secondaries

Private markets are known for their illiquidity compared to public securities that allow investors to unwind positions quickly. However, private equity returns have historically outperformed public equities due to risk-return profiles.

-

Are We Seeing a Shift Away From the USD?

In March and April 2023, China’s outbound payments were made predominately in Renminbi (RMB), a first for the currency.

-

The Increasing Significance of Retention Metrics in the SaaS Market

We are seeing a notable shift in investor focus in the SaaS sector. Rather than investing in businesses chasing growth at any cost, investors are showing increasing interest in companies underpinned by strong, sustainable business models.

-

How To Assess Potential Acquisitions and Execute for Success

There are benefits of consistently tracking your M&A pipeline – but once you have identified possible targets, how do you begin making acquisitions?

-

Purpose Has Never Been More Important

The top five accounting firms in the UK according to Accountancy Today’s 2022-2023 list come as no surprise: Deloitte, KPMG, PwC, EY, and BDO, in that order. They have a collective turnover of nearly £16 billion and 100,000 UK employees. They deal with UK companies large and small on an ongoing basis, so their sphere…

-

Embracing SaaS: Key Strategies for Success in the Digital Age

In the fast-paced digital age, Software as a Service (SaaS) has become increasingly significant. As reported by Gartner, the market value of SaaS has seen a remarkable increase, escalating from $31.4 billion in 2015 to $195 billion in 2023. This surge highlights the importance of SaaS and opens opportunities for providers.

-

The Momentum of Cross-Border Deal-Making

While the pandemic, US-China trade tensions, and other macroeconomic factors dampened international deal-making, cross-border M&A seems to be on the rise. Several key factors contribute to this trend.

-

Have You Thought About Your M&A Strategy Lately?

Though a company’s operations are first and foremost the focus of a business, many companies and investors also rely heavily on buy-and-build strategies to scale up growth and enter new markets. While a strong organic growth strategy is vital to the success of a business, having an M&A strategy, whether passive or active, can keep…

-

ESG Initiatives Are Adding Real Value

Though ESG initiatives have historically been seen as costly public-pleasing exercises, ESG-positive business choices are now often the less costly option for businesses. Over the past several years, there has been a shift in the practicality of ESG practices…

-

Combat Stagflation By Increasing Productivity

Stagflation is characterised by stagnating economic growth and high unemployment while simultaneously experiencing high inflation rates. This phenomenon was considered an impossibility until it was first conceptualised in 1965.