The Impact of Reduced Interest Rates on PE and M&A

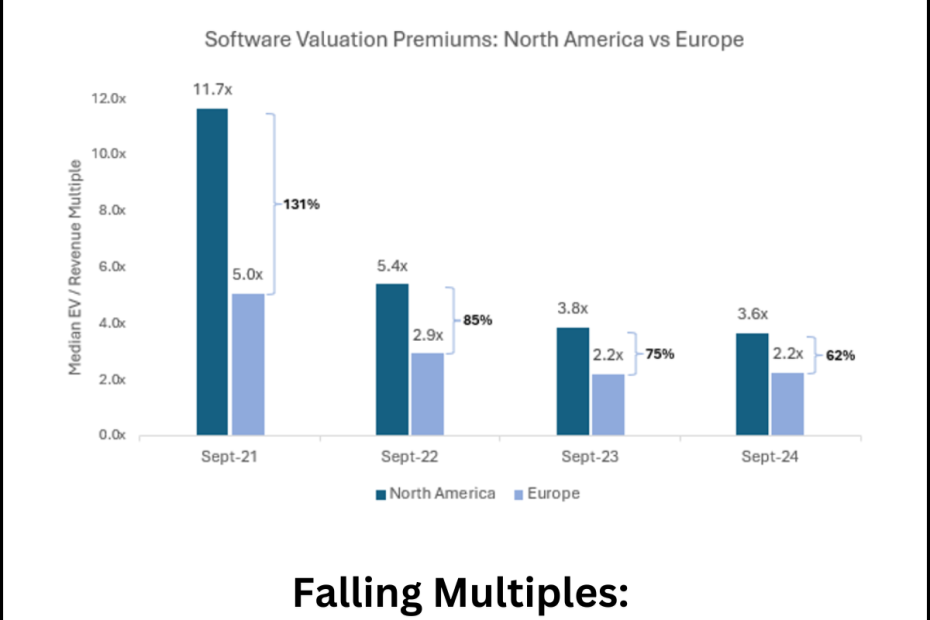

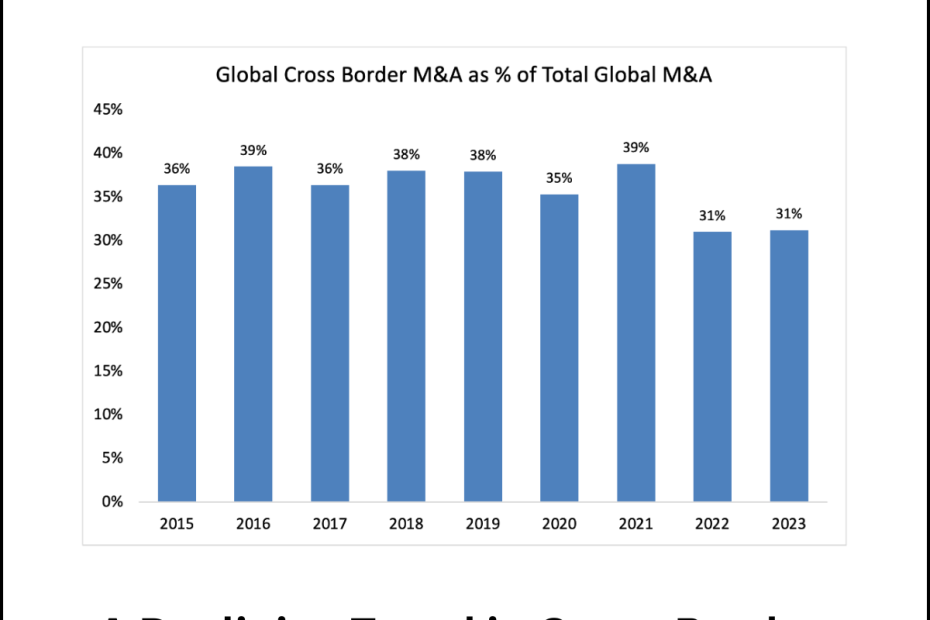

The last two years have seen decreased deal activity, largely due to incompatible valuation expectations between investors and management teams, as well as economic and geopolitical uncertainty. Across the board, we at Aalto have seen longer processes and greater hesitation…