The SVB Collapse: A new landscape for venture debt financing

The recent dramatic collapse of Silicon Valley Bank (SVB), once the 16th largest US bank, has garnered significant media coverage. SVB had $209bn in deposits and represented one of the largest bank failures, coming in second only to Washington Mutual’s 2008 downfall when it collapsed with $307bn in deposits. SVB, however, saw an unprecedented $42bn worth of withdrawals in one day – quickly surpassing Washington Mutual's $17bn withdrawn over 10 days.

SVB’s venture debt business was a vital component of funding earlier stage growth companies, and the bank’s exit has left a gap in the venture debt market.

Leading banks such as J.P. Morgan, Citi, and Bank of America have emerged as reliable alternatives for displaced SVB clients. Nonbank lenders such as venture debt funds also provide an appealing alternative for businesses pursuing debt financing, especially as concerns over the possibility of further bank failures persist. Though nonbank lenders offer funding at a higher price, earlier stage growth companies may be inclined to accept these pricier terms following SVB’s failure.

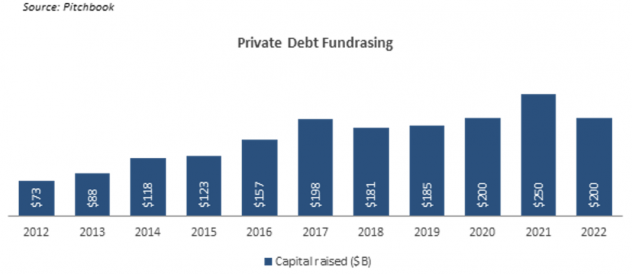

Even before SVB’s downfall, the private debt market has experienced considerable growth in recent years, with Pitchbook revealing that the total funds raised in each of the last three years have exceeded $200bn.

The SVB collapse serves as a valuable lesson for business owners and CEOs, emphasising the importance of remaining vigilant and proactive in their approach to financing. To navigate these uncertain times, be prepared to reassess and adapt your financing approach, explore a variety of lending sources, and establish contingency plans for potential disruptions. By proactively managing your company's financial health, you can mitigate risks and create a stable foundation for continued success in an ever-changing economic landscape.