Falling Multiples: How European PE Firms

Could Benefit from Shrinking Valuation Premiums

In previous articles, Aalto Capital has explored several key trends shaping the software industry, such as the size premium that favours larger companies and the role of the Rule of 40 in balancing growth and profitability. These insights have provided a framework for understanding how various factors influence software company valuations. Another important topic worth exploring is the valuation premium between North American and European software firms.

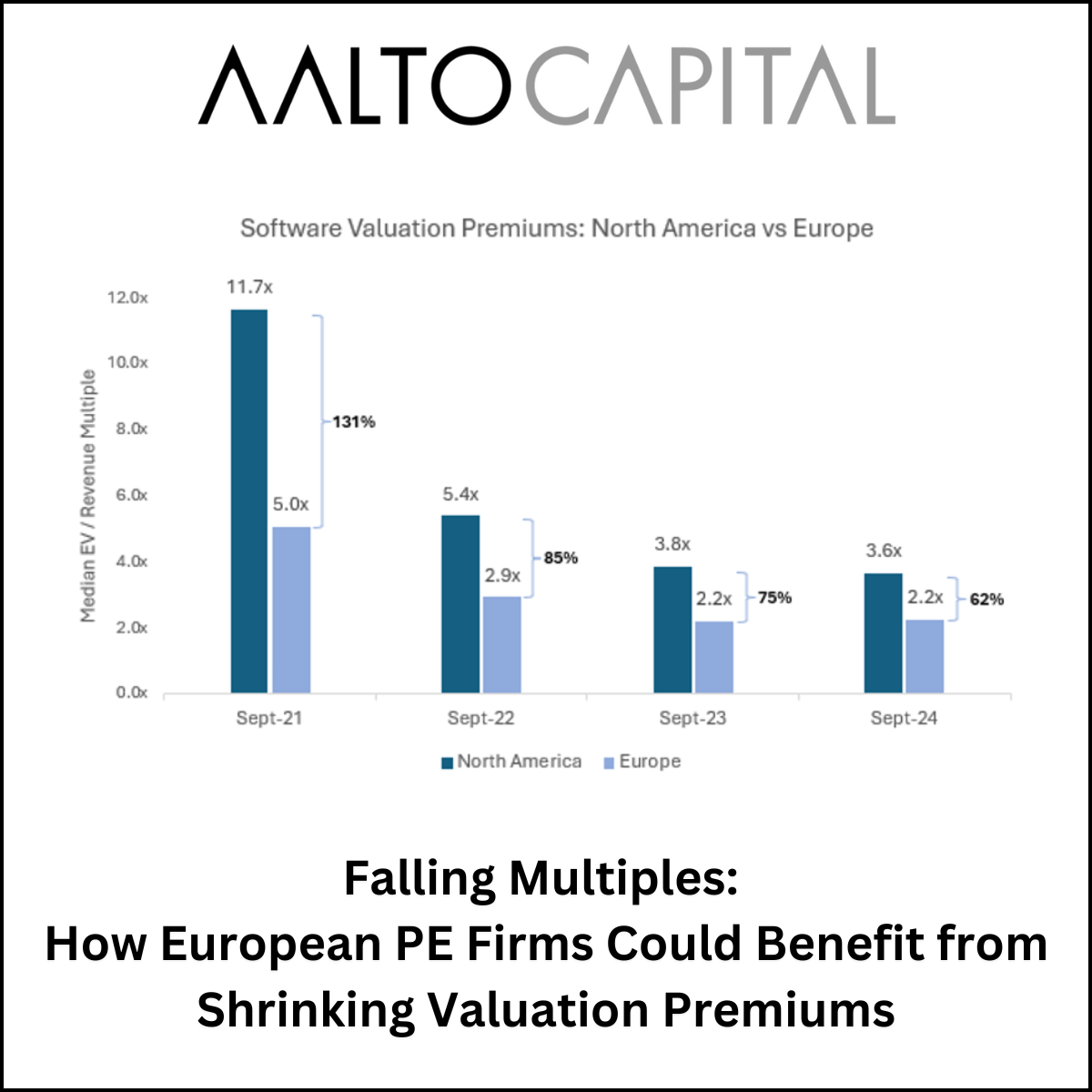

The attached graph illustrates Aalto Capital's own research into the median valuation multiples within the software market over the last four years. Software company valuations in both North America and Europe have declined significantly since the peak in 2021. At that time, North American software companies commanded a 131% valuation premium over European counterparts. In 2024, this premium has narrowed to 62%, signalling a convergence in valuations.

Several factors are contributing to the reduction. Economic headwinds such as inflation, rising interest rates over the period, and geopolitical uncertainty have affected investor confidence. European software companies have consistently traded at lower multiples, traditionally creating an alternative to the high valuations seen in North America; however, European software companies may be holding steadier due to improved operational efficiencies and greater global competitiveness. Although North American firms still command higher valuations, the decreasing premium indicates that investors are beginning to place more weight on fundamentals like profitability and growth potential, regardless of geography.

European-focused PE firms may also find themselves in an advantageous position. Unlike their North American counterparts, who may have overpaid for assets during the market peak, European firms have benefited from acquiring companies at more reasonable valuations. As the valuation gap continues to close, these firms could see stronger returns when it comes time to exit, having acquired companies at lower entry points. This could position them advantageously when valuations rise again.

Ultimately, the shrinking premium highlights Europe’s increasing appeal as a value-oriented investment destination. As European software companies continue to mature and improve their operational metrics, international investors should consider this often-overlooked market. The shifting dynamics may well favour those with a European investment focus in the years to come.