Debunking the Synergy Myth:

Why Strategic Buyers Are Paying Less in IT M&A

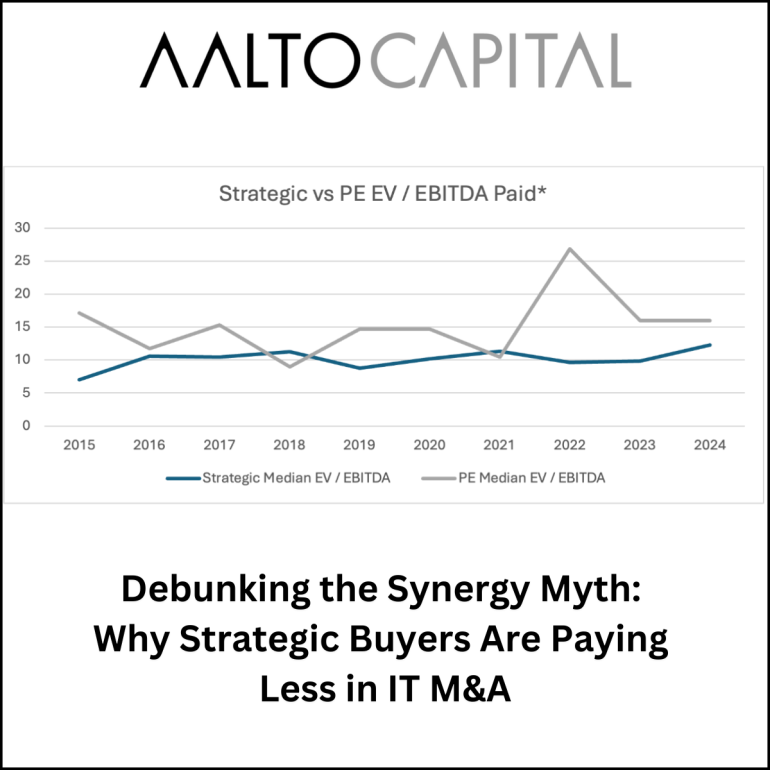

In M&A, it's often believed that strategic buyers pay more than PE firms due to expected synergies. Our recent research on the IT sector, however, reveals that from 2015 to 2024, PE buyers paid higher multiples than strategic buyers in most years.

While synergies should theoretically allow strategic buyers to justify higher valuations, several factors explain why this isn't always the case.

Firstly, integration risks play a significant role. The anticipated synergies from such acquisitions can be difficult to realize due to cultural mismatches and operational challenges. These issues often lead strategic buyers to adopt more conservative valuations as a way of accounting for potential disruptions.

Moreover, strategic buyers tend to exhibit more caution during periods of market volatility. In uncertain economic climates, they prioritise financial prudence over aggressive expansion, leading to lower bid prices compared to the more opportunistic strategies of PE firms.

Conversely, PE firms have several advantages allowing them to pay higher multiples. Due to their finite investment horizons, PE firms are driven to achieve substantial growth within a short period, compelling them to pay premiums for companies with high-growth potential.

Historically, access to cheap debt financing also enabled PE firms to leverage significant amounts of debt to finance acquisitions. With the rising interest rate environment, however, PE multiples have fallen sharply.

Despite this, PE firms continue to outbid strategic buyers to meet their aggressive growth mandates, as intense competition among PE firms for attractive targets further drives up valuations.

The higher multiples paid by PE firms in IT M&A transactions reflect PEs aggressive growth strategies and the competitive M&A market. This understanding of valuation trends is essential for making informed strategic decisions in future M&A endeavours.

*Data Sourced from S&P Capital IQ.