A Declining Trend in Cross-Border M&A and Its Implications

Cross-border mergers and acquisitions offer several benefits, such as market expansion, access to new technologies, and diversification of revenue streams. Given our European corporate finance advisory network, cross-border M&A remains an important part of our business and we are engaged in a number of cross-border transactions

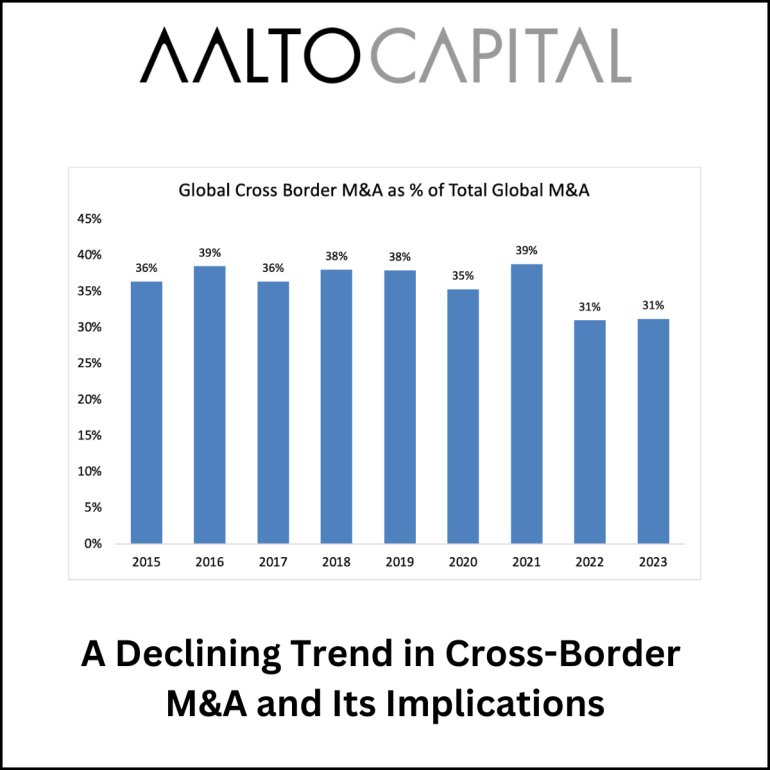

Recent data, however, reveals a notable decline in cross-border M&A activity. According to Statista, the share of cross-border M&A as a percentage of total M&A deals has dropped from 39% in 2021 to 31% in both 2022 and 2023. This trend is illustrated in the graph below, highlighting a significant reduction over the past two years.

Reasons for Decline:

1. Geopolitical Tensions: Heightened tensions, particularly in Europe and between global powers, have increased uncertainty, deterring international investments.

2. Regulatory Scrutiny: Stricter regulatory environments and protectionist policies have made cross-border deals more complex, increasing the cost and time required to complete transactions.

3. Economic Uncertainty: The global economic slowdown, driven by inflation, supply chain issues, and fluctuating interest rates, has made companies more risk-averse, favouring domestic stability over international expansion.

Implications for the Future:

1. Strategic Realignment: Companies are focusing on regions with more stable political climates, reassessing their international strategies to mitigate risks.

2. Enhanced Due Diligence: Potential acquirors are putting a greater emphasis on thorough due diligence and relying on stricter compliance procedures to navigate the complex regulatory landscapes of cross-border transactions.

3. Increased Domestic Activity: With fewer cross-border opportunities, companies are also turning to domestic M&A to achieve growth, potentially leading to a more consolidated national market.

The decline in cross-border M&A underscores the impact of geopolitical, regulatory, and economic challenges on the current market. Companies must adapt by realigning strategies, enhancing due diligence, and considering more domestic opportunities. This approach will be crucial for navigating the complexities of the current global business environment.

hashtag

#corporatefinanceadvisory hashtag

#mergersandacquisitionsadvisory hashtag

#crossboarderdealflow