The Growing Trend of Primary Listing Moves:

Implications for the UK Market

Over the past year, Aalto Capital has explored valuation discrepancies between Europe and the United States, focusing on the AIM market. This segment represents mid-market, higher-growth companies, many of which face unique challenges compared to larger, more mature businesses. Another growing trend is larger, mature companies seeking to move their primary listings abroad, driven by the need for better access to capital and more favourable valuations.

Last month, Ashtead Group became the latest company to announce its intention to move its primary listing from the LSE to the US, bringing the total value of such moves in 2024 to £107 billion, according to City AM. This trend has seen high-growth companies struggle to remain listed in the UK, while larger companies with significant US earnings are also increasingly opting to leave London.

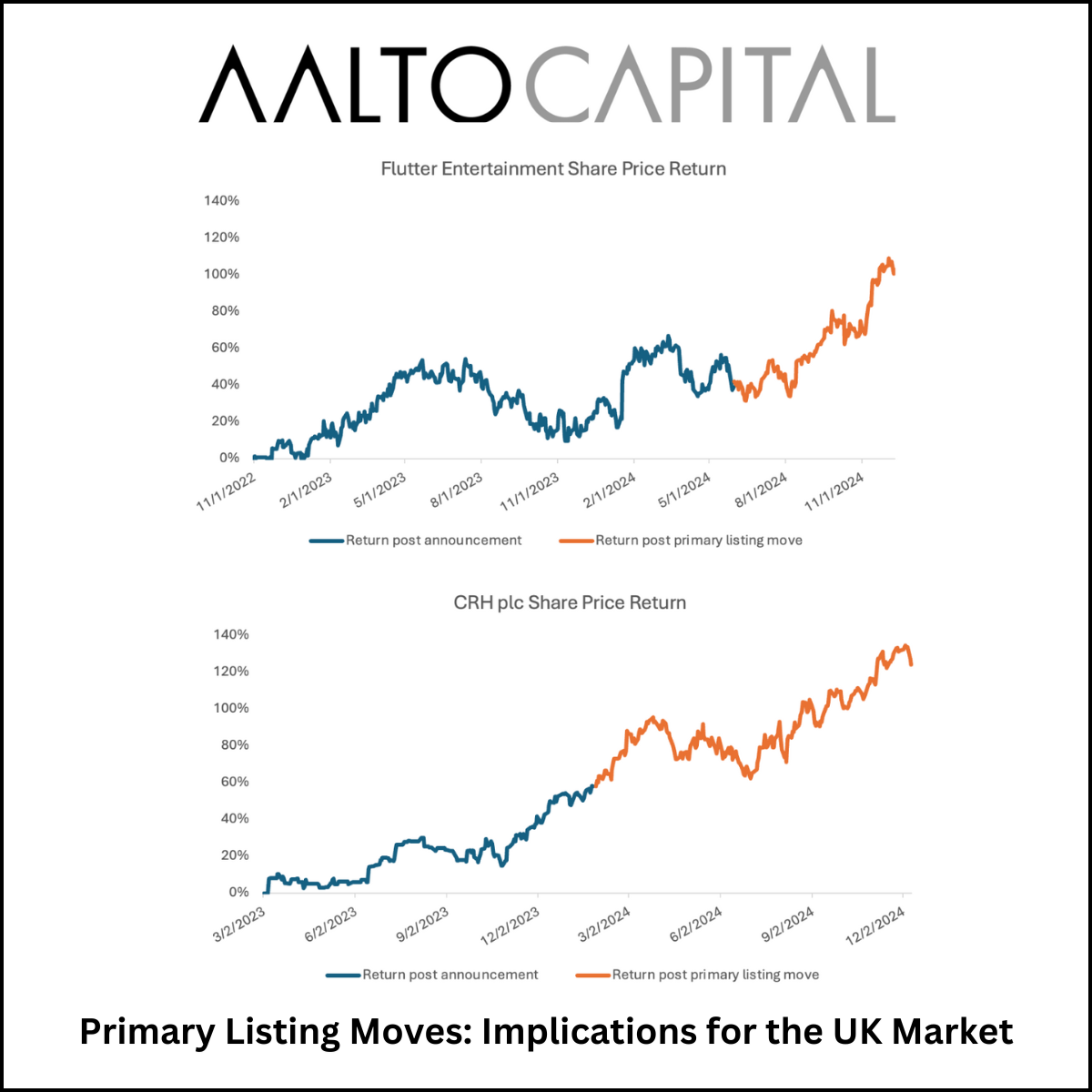

Two other notable examples are Flutter Entertainment, a dominant force in online gaming and sports betting, and CRH, a global leader in building materials. Both companies highlighted improved access to capital and stronger alignment with US investors as key drivers behind their moves.

The charts below illustrate their share price performance, tracking returns post-announcement (blue line) and post-primary listing move (orange line). These show that while initial announcements created positive momentum, the most significant valuation gains followed the completion of their listing moves.