Updating the Rule of 40:

Aalto's Latest Insights on SaaS Valuations

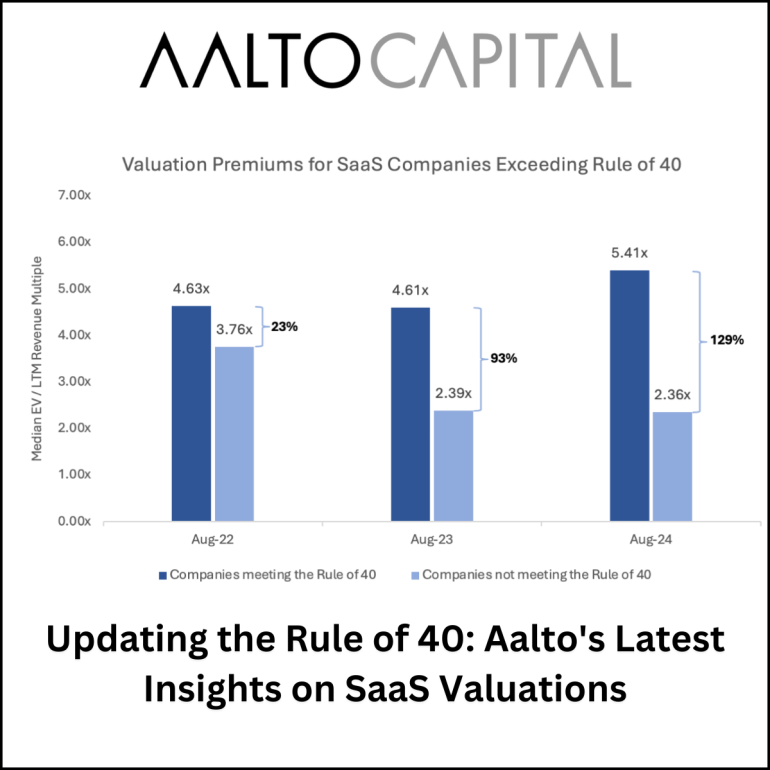

Last year, Aalto published an article on the Rule of 40, a metric that balances growth and profitability to measure SaaS company valuations. The previous analysis, based on research by Allied Advisors, examined 149 SaaS companies and defined the Rule of 40 as the sum of revenue growth and net profit margin. In contrast, Aalto's recent analysis, using data from S&P Capital IQ, focuses on EBITDA margin instead of net profit margin.

EBITDA is preferred as it excludes non-cash expenses like depreciation and amortisation, providing a clearer picture of a company’s core operating performance and cash flow.

Aalto's updated research also expands the scope to 504 software companies across Europe and North America, offering a more comprehensive analysis of how adherence to the Rule of 40 affects valuation premiums.

The findings reveal a growing trend: valuation premiums for companies meeting the Rule of 40 are increasing. The chart shows that companies exceeding this threshold consistently attract higher multiples, with the premium rising from 23% in August 2022 to 129% by August 2024.

The rising premium for companies meeting the Rule of 40 indicates that investors are increasingly valuing a balanced approach to growth and profitability. In uncertain economic conditions, companies demonstrating sustainable growth alongside profitability are more likely to achieve higher valuations and attract investment.

Aalto's latest research confirms the Rule of 40 as a vital benchmark for SaaS companies. To optimise market value and attract investors, SaaS businesses should focus on strategies that maintain a balance between robust growth and sustainable profitability.