Acquirers are carefully planning post-merger integration strategies

To optimise value during post-merger integration and safeguard against valuation drops, management teams must enact comprehensive strategies to ensure successful company integration and enhance subsequent increases in valuation.

Numerous factors can contribute to a decrease in the combined value of merged entities including integration challenges spanning from cultural misalignment to operational disruptions. Moreover, delays in successfully integrating can impact valuation, as investors may grow impatient after 12-18 months of lower-than-expected performance.

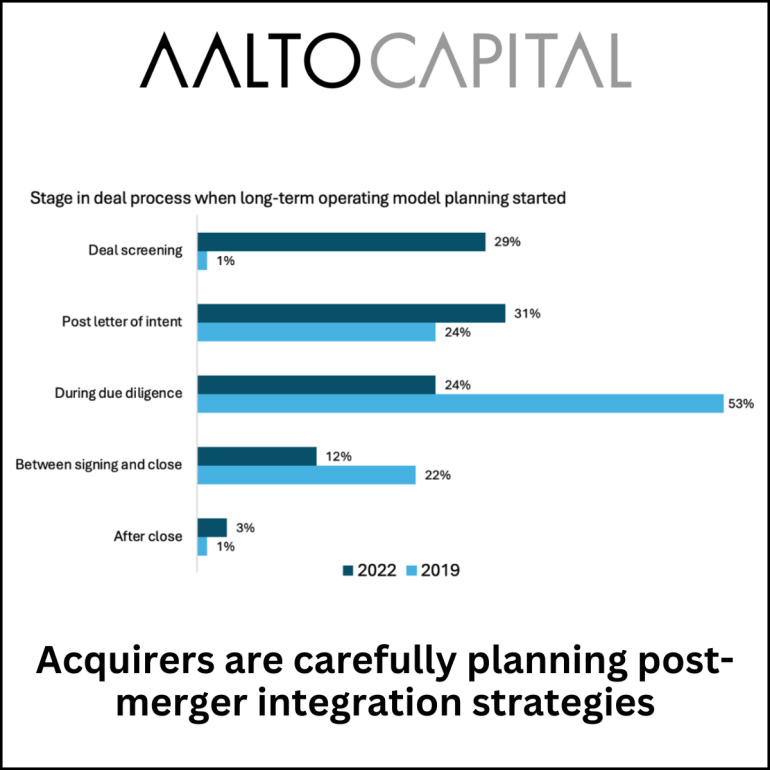

To fully realise the potential of an acquisition, focused attention must be given to synergy capture and integration strategy early in the deal process. PwC’s 2023 M&A Integration Survey revealed that acquirers were planning long-term operating models at earlier stages of M&A transactions. In 2019, just 1% of respondents said they began planning post-merger operating models at the time of deal screening, compared to 29% in 2022.

Integration spending increased over the same period with 21% of respondents spending over 10% of the deal value on integration vs only 6% three years prior. These higher upfront integration costs should have long-term strategic and financial benefits.

Management should devise a synergy realisation plan, with line leaders taking ownership of these responsibilities, where clear, prioritised objectives owned by department heads instil accountability.

Continuous monitoring of key performance indicators (KPIs) throughout the post-transaction period is paramount to ensure synergy realisation aligns with plans. Once KPIs are established, robust data collection and analysis are imperative to evaluate success. This includes developing comprehensive financial and headcount baselines to track the effectiveness of synergy initiatives.

The ultimate goal of synergy realisation is not without risks, especially with companies paying more to integrate. The selection of leadership post-merger is crucial, and meticulous planning and effective management can mitigate risk and ensure successful integration.